As technologists with a long track record in building CRM products, the team at Wealthbox chose early on to specialize our product for the vertical of wealth management to meet the needs of financial advisors – our niche. That’s why it’s interesting to see some of our advisory firm customers do the same, by focussing their financial planning services to a niche group of clients, in this case, doctors.

MD Financial touts itself as “the personal CFO for busy doctors” and judging by their extraordinary growth, they’re quite busy themselves in providing financial advice nationwide to doctors from Maine to Hawaii.

“Wealthbox is a breath of fresh air!”

Operating from two main office locations in Minnesota and Rhode Island, MD Financial is headed up by president Katherine Vessenes (pictured above) who is a practicing CFP and has an impressive background in training and consulting in financial services. With a tech-forward culture that makes rigorous use of video-conferencing and modern tools like Wealthbox to manage prospects and clients, MD Financial, after 8 years in business, is now servicing about 500 physicians across the country to assist them with their financial planning goals. 95% of them come to MD Financial by way of referrals from other doctors. It’s a viral and healthy niche!

Why MD Financial Finds the CRM Cure in Wealthbox

User Experience

“Wealthbox is a breath of fresh air!” says Katherine and her team in a recent customer interview. “We used two different advisor CRMs before Wealthbox, but they were bloated, click-intensive, and clunky,” they explain. What lowers the MD Financial team’s collective blood pressure and improves their happiness is the user-experience with the modern, intuitive interface of Wealthbox.

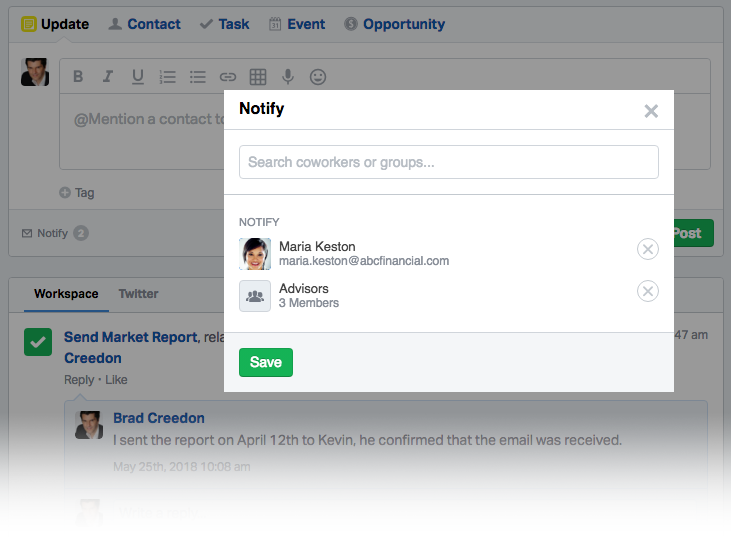

Collaborative CRM

MD Financial operates as a team-based practice and they depend on the collaborative features of Wealthbox. For instance, with Wealthbox’s notification alerts in the activity stream “we get out of email and use Wealthbox to communicate as a group” they say. With Wealthbox, “everything is in one place.”

Tagging in Contact Management

A niche has niches, and servicing doctors who are clients gets granular with the use of group tagging – e.g. “physician,” “resident,” “fellow,” etc. – in the contact management section of Wealthbox. Says the MD Financial team: “There’s so few clicks to do tagging in Wealthbox, which makes segmenting our client base of physicians super easy.”

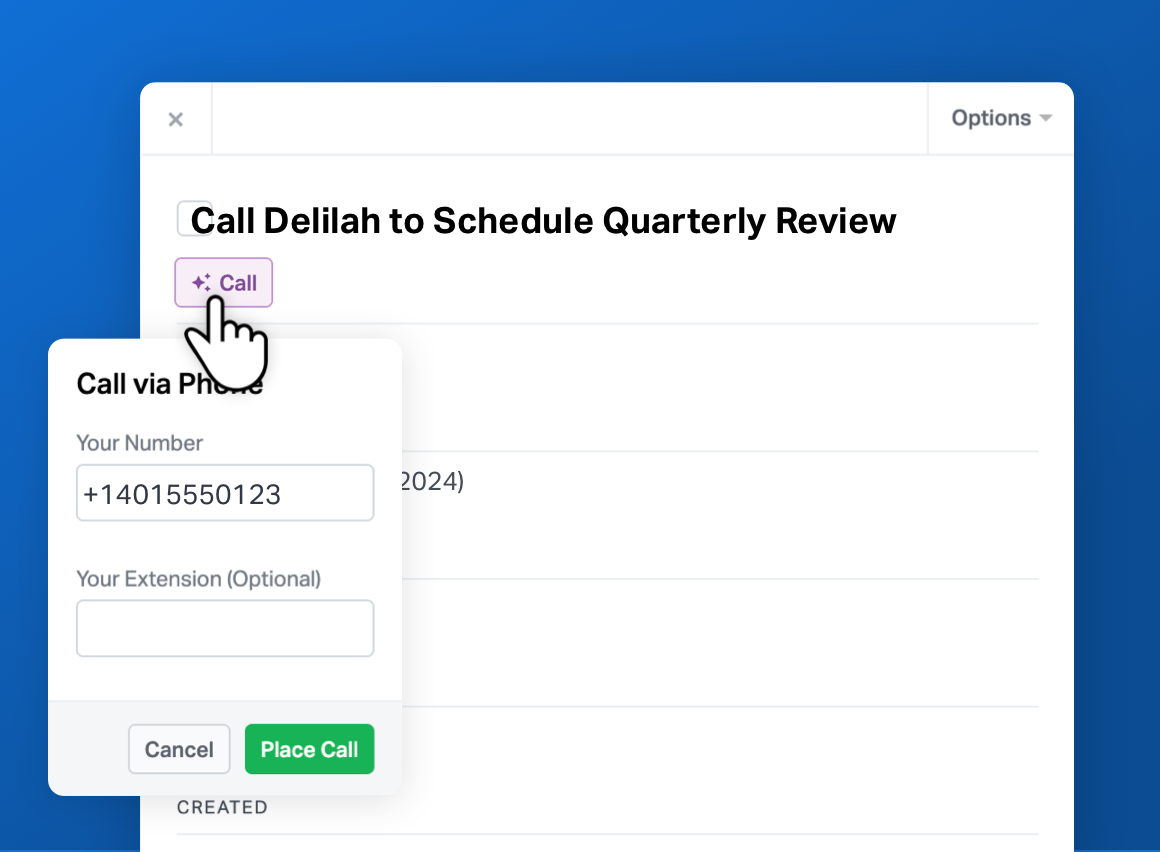

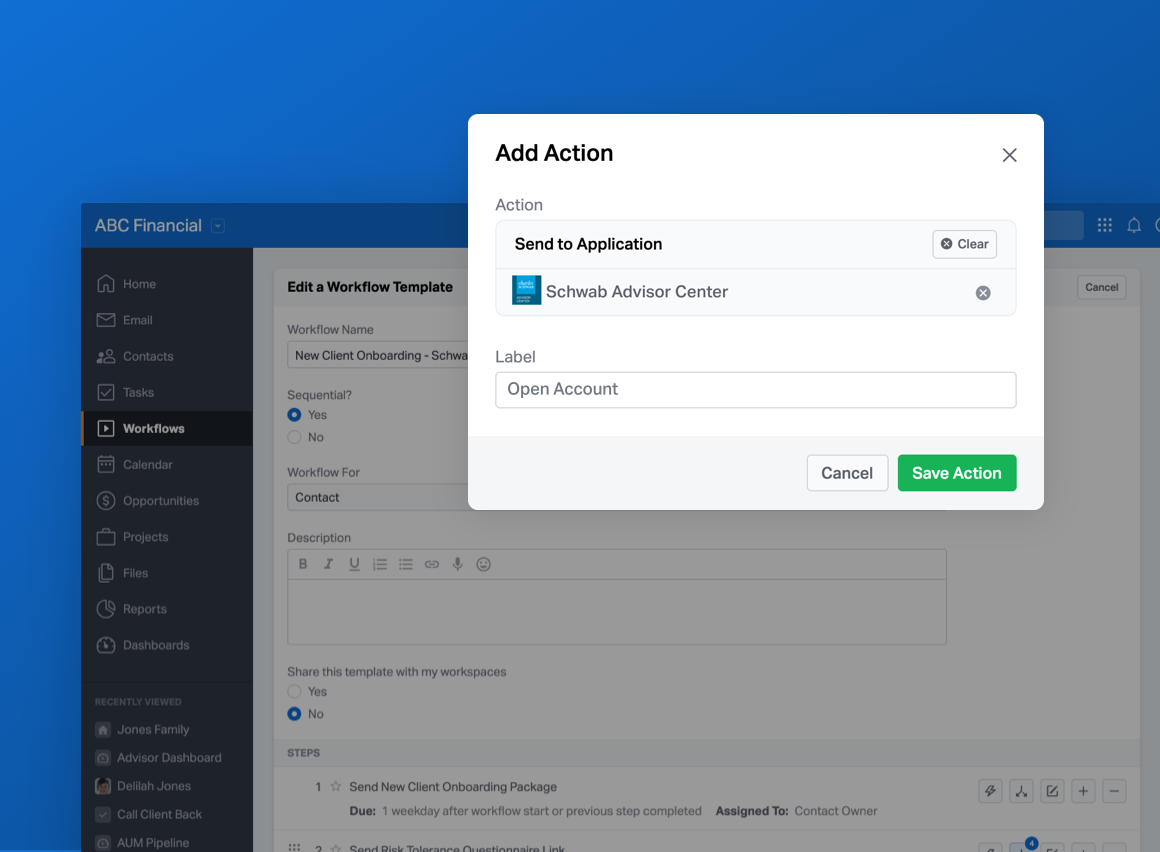

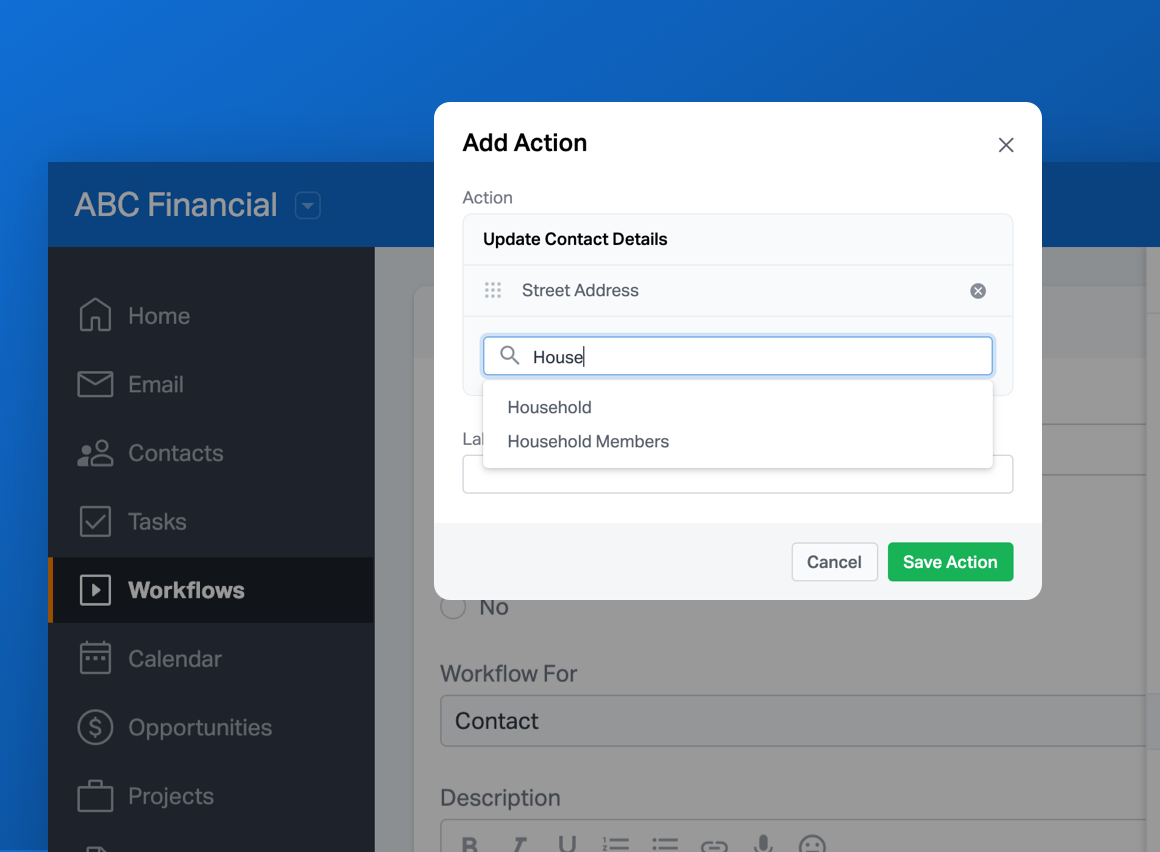

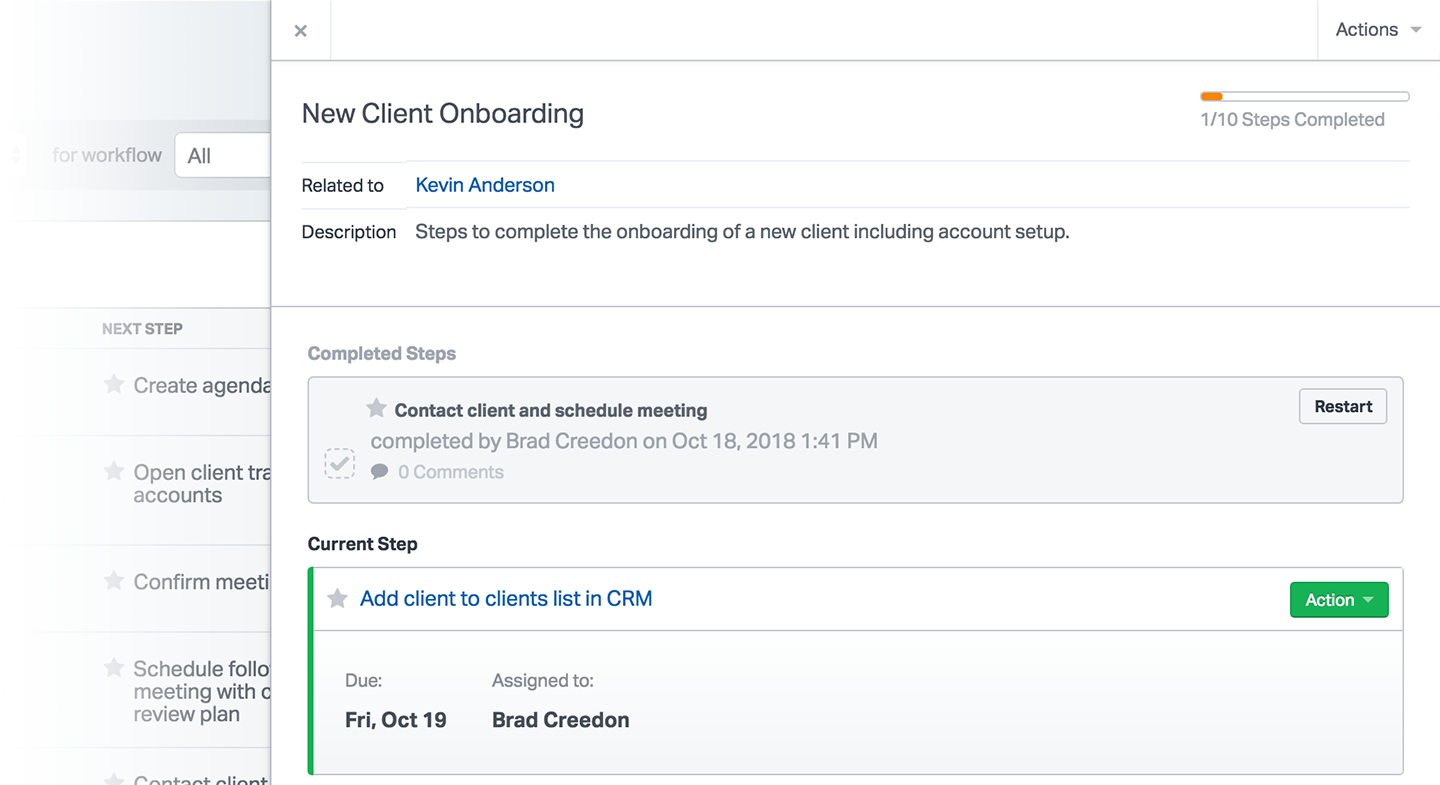

Automated Workflows

MD Financial has a templated formula for meeting with prospective new clients that’s proven highly successful to their growth. There are no “one-off” meetings; all are scripted and have a specific objective. And all of their meetings – most by videoconferencing – follow a well-honed system of engagement. It’s MD Financial’s “playbook” as they call it. To help manage this process, the team uses Wealthbox automated workflows and the “checklist” feature to track their progresses with each new engagement. It proves successful: MD Financial onboards 7 new physician clients per month on average.

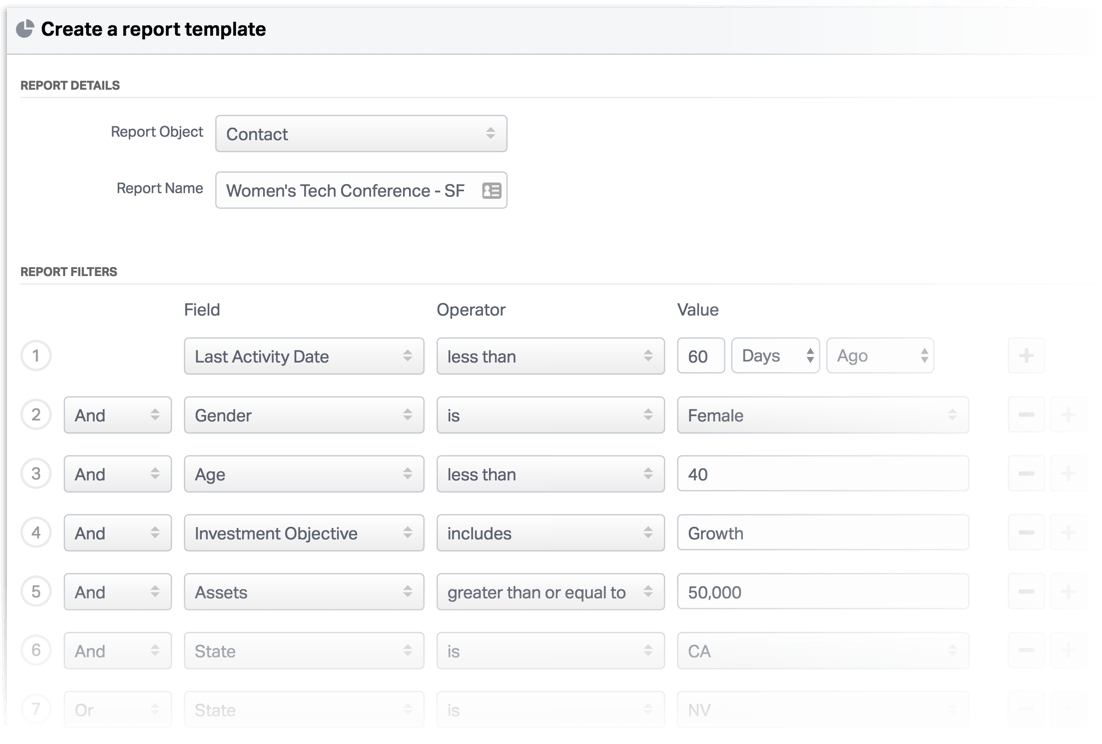

CRM Reports

MD Financial has business requirements that demand calculations that return the data sets they need to operate their business and for that they use the Reporting function in Wealthbox CRM. The team dynamically generates and save customized CRM reports for better analytical insight into their practice that targets physicians. The financial planning team create templates with various criteria patterns to run customized reports on-demand to dig deeper in the underlying data.

Data migration to Wealthbox

“Switching to Wealthbox was painless!”

For financial advisors, leaving an old-school CRM and transferring their client data to a new CRM can be perceived as daunting. But times have changed, and CRM data mapping to easily migrate data can be a breeze when onboarding onto modern technology platforms like Wealthbox.

“Switching to Wealthbox was painless!” says Katherine. “And the Wealthbox support team is responsive and friendly. We migrated our data with ease and it was quick. Quite frankly, we wouldn’t be where we are today without Wealthbox.”

Advisors: Not yet a subscriber to Wealthbox? Start a free trial!