CRM Software Comparison for Financial Advisors

For advisors, finding the right CRM can be overwhelming. Our wealth-tech CRM comparison pages give you the information needed to make a decision between Wealthbox – the highest-rated CRM for financial advisors – and other advisor CRM alternatives. We also offer guidance on how to switch to Wealthbox – with ease.

Full access. No credit card required.

What questions should I ask before choosing a new CRM?

You’re already using CRM, but do you know the questions you should be asking to evaluate a new CRM and make a switch?

How does “user experience” improve productivity?

It’s crucial to understand that the user experience among competing CRMs is vastly different. Feature comparisons of tasks, workflows, integrations, etc. are apples-and-oranges between competing CRMs. It’s important – for you! – to actually use a new CRM in a free trial before you buy. The user experience matters, and modern CRM software, with sleek and elegant design, significantly improves user adoption, happiness, and ultimately productivity to build and manage your advisory practice.

Tip: Check out why Sanctuary Wealth made a switch from Salesforce CRM.

How simple is it for my team to learn?

In the wealth-tech space, old-school CRMs that are 20 years old can be clunky, bloated, and hard to learn. If classroom training to learn a CRM is required, that’s a warning sign of impending lost time and productivity. It’s crucial to find a modern CRM product that’s powerful yet intuitive. A new generation of CRM with “social design” for coworker collaboration and ease of use is now available from some CRM vendors.

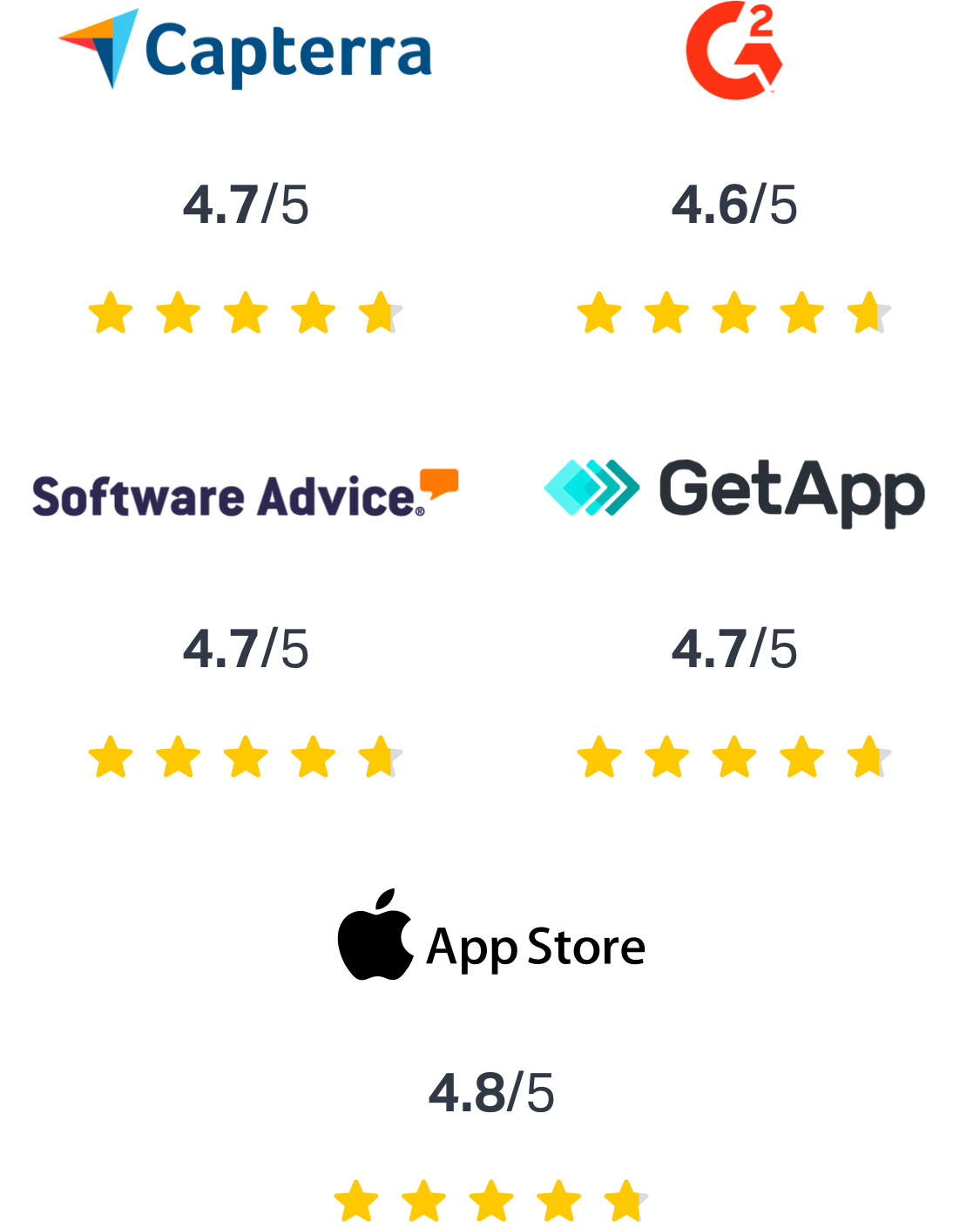

Tips: Read reviews of Wealthbox review on G2 and Capterra vs. competitors. Also, see how “social CRM” increases team collaboration at advisory firms.

What about CRM integrations?

CRM is the core software of a financial advisor’s tech stack. It’s the hub to integrations with custodial platforms, portfolio management, financial planning software, risk analysis, and all other complementary wealth-tech apps. There are various levels of integrations, from single-sign-on to two-way data sync between applications. Again, it comes down to actually trying to see if the integrations actually work well before making a CRM buying decision.

Tip: Look for CRMs with over 100 integrations to leading custodians and wealth-tech applications.

What kind of support does it have?

Customer support for CRM software is essential for financial advisors as it enables them to efficiently manage their clients’ financial needs and provide them with personalized services. As a result, it helps financial advisors to build strong relationships with their clients, which is critical to their success. Excellent support from CRM vendors – through telephone help desk, screen-sharing, knowledge base, etc. – is crucial to see in action in a free trial.

Tip: Check out examples of support, including help desk, how-to videos, and knowledge base Q&A, and data migration services.

How easy is a CRM data migration when switching?

Data migrations between CRM vendors is much easier today than it was years ago. Tech-enabled services within a CRM vendor’s infrastructure, along with high-touch, white glove service for advisory firms is available to make the process surprisingly simple and fast. Many CRM vendors today have (or should have) a secure and well-honed migration process that includes an assigned specialist who is there every step of the way.

Tip: Check out how to transfer your CRM data in 3 easy steps.

Compare Wealth Management CRMs

See how Wealthbox compares to other CRM alternatives.

“Wealthbox Raises $31 Million After Converting Salesforce and Redtail CRM Users and Leaping Up the Marketshare Ranks.”

RIABiz, March 2022

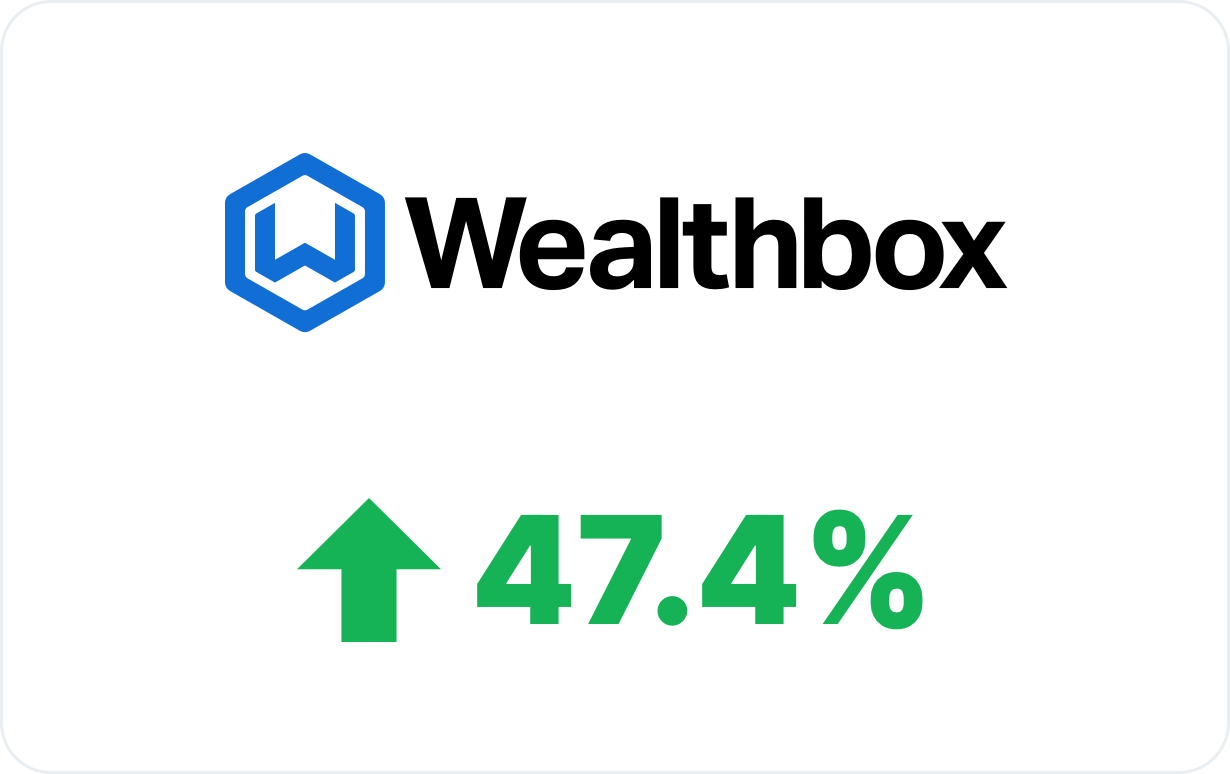

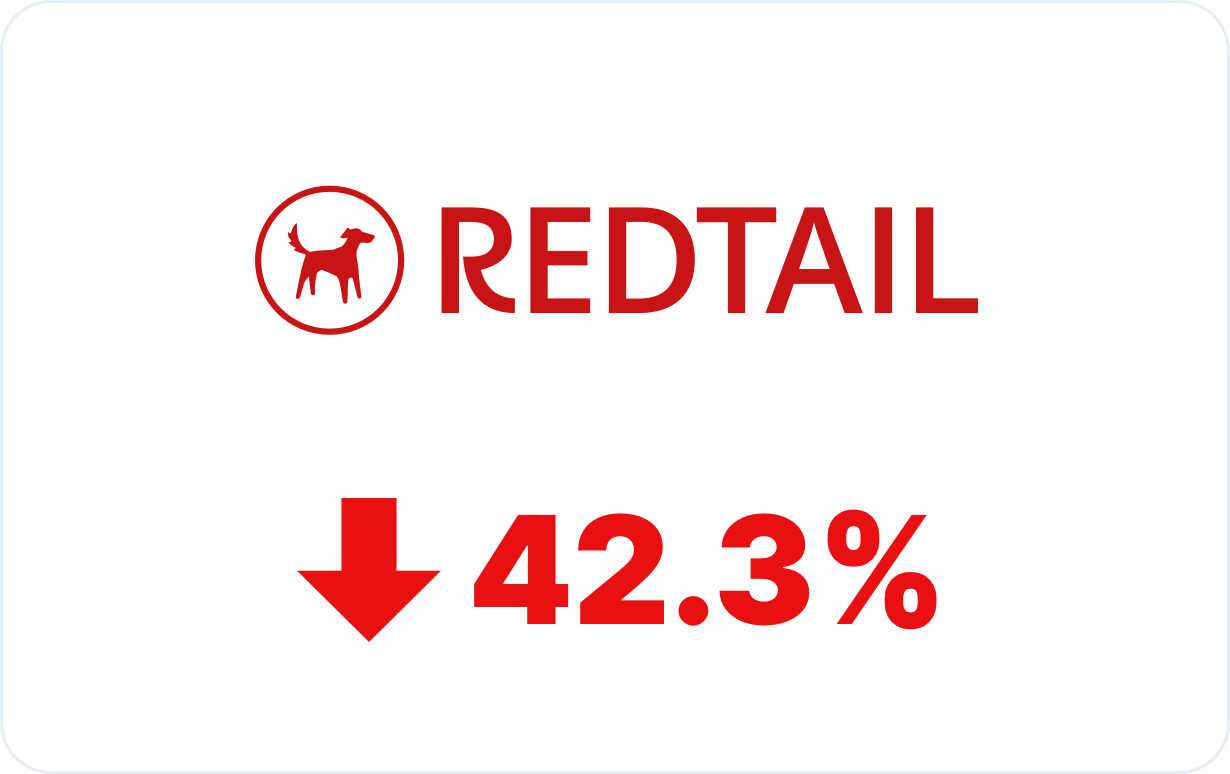

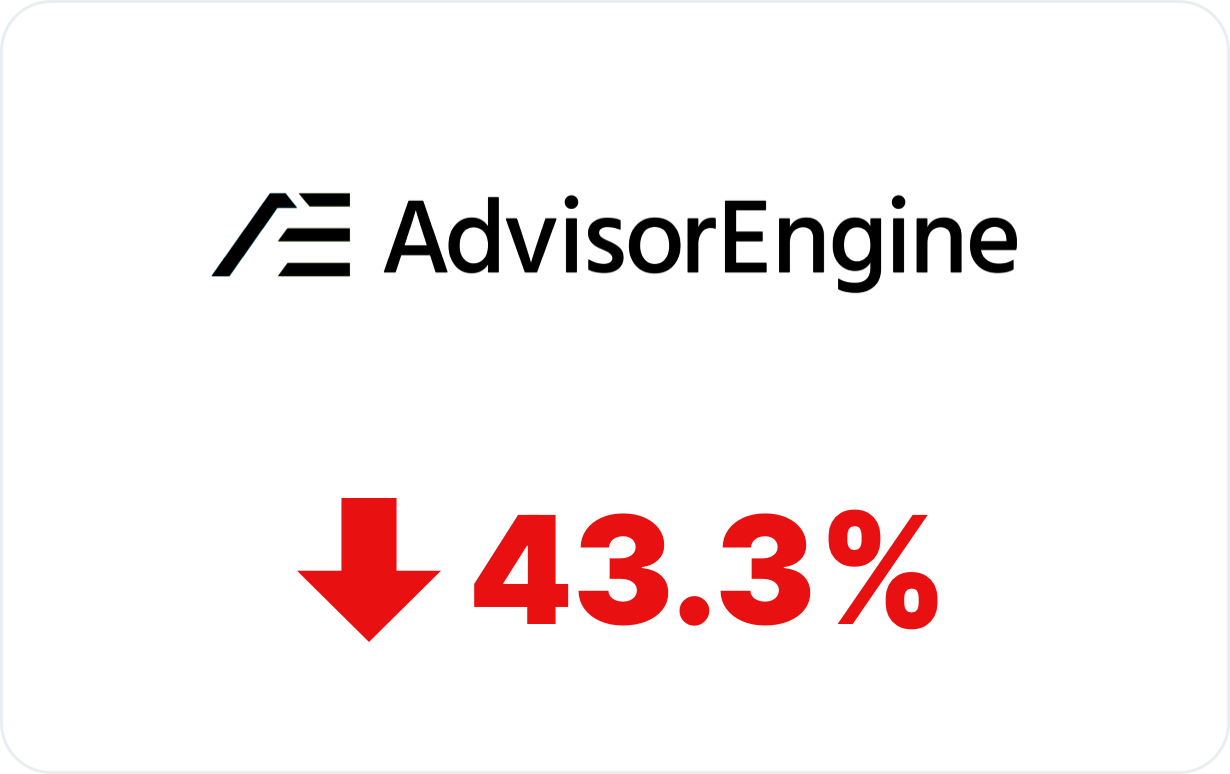

RIA Market Share: Growth Rates 2024 – 2025

Source: T3 / Inside Information Survey, March 2025

7 Reasons Why Advisors Say They Switch CRMs

Comparing CRMs to make the best decision is important. Additionally, user comments we hear from advisors about why they are switching to Wealthbox are revealing.

1. Difficult to use

“Clunky” and “bloated” are common descriptions by advisors about some CRMs that can tick off advisors. The user experience is poor and ultimately costly in the amount of wasted time it takes to do everyday actions in the CRM. The end result is low adoption of the firm’s CRM.

2. Old-school interface

“I’m a financial advisor, not a data-entry clerk!” says an annoyed advisor when leaving an old-school, poorly designed CRM with a dreary interface. Design elegance and beauty matter in modern CRM software.

3. It requires training

Old-school CRMs have steep learning curves, and it drives advisors crazy that training classes are required to learn them. Some CRMs even require a full-time administrator to keep them working properly. “I’d rather figure out my clients than spend time figuring out my CRM!” an advisor told us.

4. It’s dehumanizing

Many CRMs lack modern social design for advisor teams to collaborate and get work done with humanized activity streams, notifications, and even socially expressive emojis. Says one Wealthbox switcher: “My previous vendor calls their CRM product a ‘database’ and I love how Wealthbox calls its product a ‘workspace.’ That’s very telling.”

5. Poor performance

Buggy, poorly engineered CRM software that regularly crashes from server failure annoys advisors. Down time is a big time problem. “The frequent display of the ‘500 error page’ shouldn’t be part of a CRM user experience!” says one advisor, echoing the sentiment of many.

6. Apples & oranges feature comparisons

Millions of dollars have been wasted on failed implementations of CRM. Sometimes those spiffy comparison checklists of CRM features touted by vendors don’t translate well for end-users. “I should have actually used the CRM system instead of reading a checklist of features” gripes an advisor.

7. Hidden pricing

Beyond a CRM vendor’s pricing page, there are often unseen, expensive costs like training, implementation, administration, and extra add-ons to the product. “When you add these extra product costs, in addition to the productivity cost of low adoption in not using the CRM, it’s a serious issue!” an angry advisor told us.

Features to look for in a CRM for financial advisors

Wealthbox has all the tools a modern advisor needs in a CRM.

Contact Management

Activity Streams

Calendar Events

File Storage

Two-Way Email Sync

System Reporting

Desktop & Mobile Apps

Enterprise Ready

Task Management

Automated Workflows

Opportunity Tracking

Visibility Permissions

Portfolio Integrations

Advanced Security

Account Administration

SOC 2 Certified

“When we switched, CRM user adoption increased and every single branch office shared glowing feedback that they preferred Wealthbox over Salesforce.”

Jack McCormack

Managing Director at Sanctuary Wealth

500 users on Wealthbox

Frequently Asked Questions

How do I subscribe to Wealthbox?

First, start with a free 14-day trial here. Then, once logged in, go to the three dots in the upper right corner of the Wealthbox interface and select “Subscribe” to pay with a credit card. You can also schedule a call with our sales team to discuss Wealthbox on the phone and in a demo.

Which pricing plan is right for me?

We understand that each financial advisory practice is unique, requiring specific features to support its operations. Check out the pricing page to see the features included in the different plans to support your needs. If you need help in choosing the right plan for you, reach out to our sales team to discuss on the phone or in a demo.

Can I change my plan?

Yes. You can make changes to your plan at any time including adding or removing users. Simply go to the Billing section and click the “Change” link next to your billing cycle.

Does Wealthbox offer any discounted plans?

Talk to our Sales team to understand what, if any, discounts might be available for your firm.

How can I manage my billing?

If you are the “account owner” or “admin” of your account, you can access your purchase history, invoices, payment details, plan type, and more in the Billing section.

How secure is Wealthbox?

Wealthbox is a SOC 2, Type 2-certified organization that meets the highest standards of security to ensure your account and data are safe. We use bank-level security and 256-bit encryption to safeguard data and we have a range of extra security features, like session time-out, and two-factor authentication.

Does Wealthbox have mobile apps?

Yes, Wealthbox provides a companion mobile app – with the highest ratings from advisors of any wealth-tech CRM – that are available to download for Apple iOS and Android devices. The Wealthbox mobile app is fully synced with your web-based Wealthbox account.